Outrageous Tips About How To Apply For Homestead Exemption In Texas

How do i get a general $40,000 residence homestead exemption?

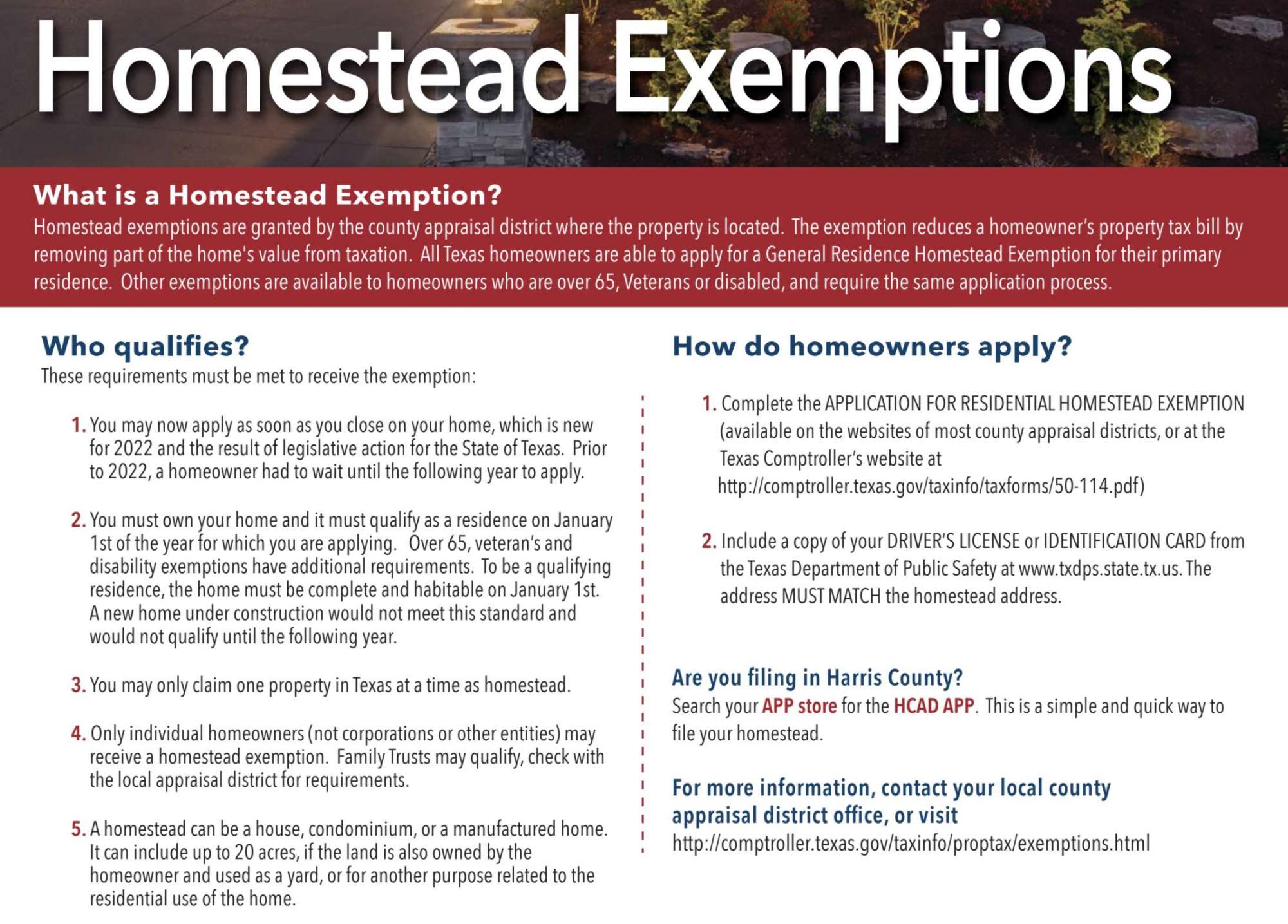

How to apply for homestead exemption in texas. Exemption applications can be submitted by mail, online, or at our office: Requirements are a texas issued driver license or identification card showing. Download homestead exemption application the above collin county appraisal district form is in adobe acrobat pdf format.

Individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption for school district. To qualify for the general residence homestead exemption, you must meet a few requirements, including: The typical deadline for filing a county appraisal district homestead exemption application is between january 1 and april.

Action on your application will occur within 90 days from the date it is. Age 65 or older and disabled exemptions: Is it too late to file for homestead exemption texas?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the texas property tax code. Property owners applying for a residence homestead exemption file this form and supporting documentation.

Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the. Who qualifies for the general texas homestead exemption? For the $40,000 general residence homestead exemption, you may submit an application for residential homestead.

How to file for the homestead exemption a qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. How do i qualify for texas homeowner exemptions? If you do not have adobe acrobat reader software on your.